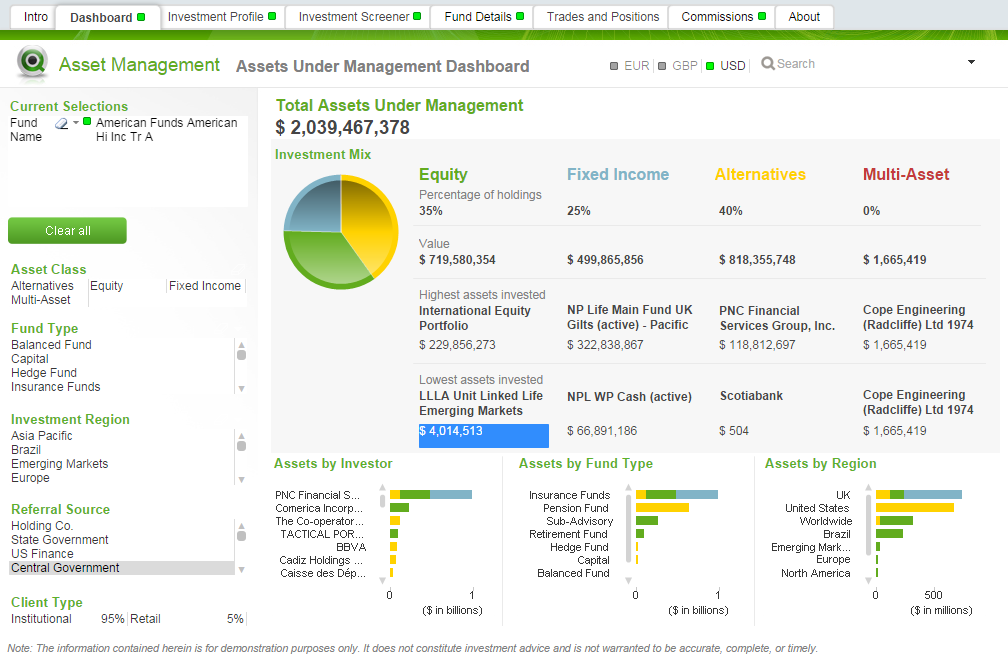

Jedox is an Excel based financial planning software. Financial data is often difficult to audit and unreliable because of ineffective controls in Excel. The issues surface in overworked teams, manually reconciling data scattered across multiple systems and countries. Traditional BI/PM software needed specialised technical teams to develop and maintain them. Waterfall implementations meant Finance filled out requirement documents, explained basic finance concepts to the technical team - and then waited for the result. The business process (that Finance was still ultimately responsible for) was no longer under Finance’s control. To manage this, agile companies adopt the Jedox Suite. Jedox gives you unified planning, consolidation and reporting in one intuitive solution.

Knowledge Management Solutions, an authorized Jedox partner in Singapore, is having a free event to introduce this great platform to finance specialists in Singapore at 3pm - 5pm, on 28th August 2015. The address of this free Jedox event is Singapore Management University 60 Stamford road

Singapore, 178900.

For more details and registration, please visit Register for Jedox Finance Data Analysis event. Watch a short video of Jedox below to see the capabilities.

Knowledge Management Solutions, an authorized Jedox partner in Singapore, is having a free event to introduce this great platform to finance specialists in Singapore at 3pm - 5pm, on 28th August 2015. The address of this free Jedox event is Singapore Management University 60 Stamford road

Singapore, 178900.

For more details and registration, please visit Register for Jedox Finance Data Analysis event. Watch a short video of Jedox below to see the capabilities.